题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The Central Bank lowered interest rates_____2 percent.A. byB. overC. forD. at

A. by

B. over

C. for

D. at

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A. by

B. over

C. for

D. at

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The Central Bank lowered inter…”相关的问题

更多“The Central Bank lowered inter…”相关的问题

There is no reliable index of inflation, because______.

A.the currency is cheap

B.there are different ways to get the index

C.the index have been manipulated by the government

D.the central bank has kept rates low

The dollar also dipped to a nearly five-year low against the yen, but later regained ground.

Yesterday, the euro rose to $1.3329 in early trading before dipping back to $1.3290 later in New York. The euro topped $1.32 for the first time the day before in European trading. US markets were closed Thursday for the Thanksgiving holiday.

The dollar also traded near its lowest levels since December 1999 against the Japanese yen yesterday, slipping to 102.56 yen, down from 102.81 late Wednesday in New York.

One reason the euro has kept rising is a lack of concerted action by central banks to support the dollar by selling holdings of the other major currencies.

"$1.35 is definitely on the cards now, as for how soon we'll get there, I'm not sure," said Riz Din, a currency analyst with Barclay's Capital in London.

"It increasingly looks as if, despite weaker data in the euro area, the prospects for intervention, are very, very low at current rates."

The latest dollar collapse, fueled by concerns over the US trade and budget deficits, has taken the euro from around $1.20 about two months ago.

Because the euro's rise tends to make European products more expensive, European leaders have voiced fears that it might hurt the continent's export-driven economic recovery. The European Central Bank's president has called the rapid increase "brutal".

But the dollar's weakness is good news for US exporters, helping make American products less expensive overseas.

Commerzbank economist Michael Schubert said speculation against the dollar was making its slide "a bit faster than I had expected".

"Obviously, it's difficult to stop the train," Mr. Schubert said in Frankfurt. A combination of intervention by central banks and positive US economic data could apply the brakes, he added.

Economists say the European Central Bank (ECB) is wary of intervening in the currency markets on its own and the United States Would be unlikely to join in such a move.

According to the text, the dollar

A.has reached its lowest level against euro yesterday.

B.was lower than euro in the past four continuous days.

C.is still staying in a worse position than the yen.

D.kept failing despite the central bank's adoption of active measures.

The American central bank was reluctant to raise interest rates because ______.

A.everybody saw consumer prices rise again.

B.signs of robust economic recovery multiplied.

C.investors reaped rewards in futures markets.

D.it wanted to stay away from risks involved.

We can learn from the text that the America's central bank ______.

A.took advantage of rate-cuts policy as an insurance policy.

B.is fairly conservative in raising short-term interest rates.

C.tried to stop consumer prices from free falling but in vain.

D.place monetary policy-making in the hands of Walk Streeters.

The factor NOT accounting for the slide of dollar is

A.the US trade and budget deficits.

B.the lack of any central bank action.

C.the speculation against the dollar.

D.the sales of other major currencies.

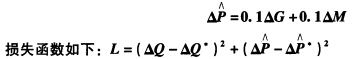

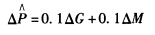

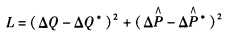

当中央银行不改变货币政策时,政府希望不改变产出水平,又能降低通货膨胀2%时的最佳财政政策是什么?损失函数的值是什么? c.如果中央银行愿意合作,最佳政策组合是什么?损失函数的值多大? In some countries,the central bank is independent from the government.Consider a situationin which the government wants to reduce inflation without changing output,but the central bank would not change monetary policy. a.Can the government achieve its objectives by using only fiscal policy?Why? b.Assume that the effect of instruments on targets in this economy are represented by the following model(in deviations from the baseline):

当中央银行不改变货币政策时,政府希望不改变产出水平,又能降低通货膨胀2%时的最佳财政政策是什么?损失函数的值是什么? c.如果中央银行愿意合作,最佳政策组合是什么?损失函数的值多大? In some countries,the central bank is independent from the government.Consider a situationin which the government wants to reduce inflation without changing output,but the central bank would not change monetary policy. a.Can the government achieve its objectives by using only fiscal policy?Why? b.Assume that the effect of instruments on targets in this economy are represented by the following model(in deviations from the baseline):

and the loss function is

and the loss function is

What is the optimal fiscal policy that the government should pursue when its objectives are to reduce inflation by two points without changing the level of output,if the central bank does not change monetary policy?What is the value of the loss function? c.Assume nOW that the central bank decides to cooperate.What is the optimal policy mix?What is the value of the loss function?

What is the optimal fiscal policy that the government should pursue when its objectives are to reduce inflation by two points without changing the level of output,if the central bank does not change monetary policy?What is the value of the loss function? c.Assume nOW that the central bank decides to cooperate.What is the optimal policy mix?What is the value of the loss function?

Why might EMS provisions for the extension of central bank credits from strong-to weak-currency members have increased the stability of EMS exchange rates?

on will consider widening the yuan’s trading band。

But any change in the yuan’s floating band will depend on the global economic situation and it’s not the only tool the country would use to make its currency more flexible,Zhou said at the Group of 20 meeting in Cape Town,South Africa。

China widened the yuan’s daily trading band against the U.S. dollar from plus or minus 0. 3 percent to 0. 5 percent in May。

However,market observers said some commercial banks are ordered by the central bank to hand in reserve requirements in foreign currencies next week,which will translate into demand for the U.S. dollar. This will somehow help slow down RMB’S appreciation against the greenback in the coming few days。