题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Hebac Co is preparing to launch a new product in a new market which is outside its current

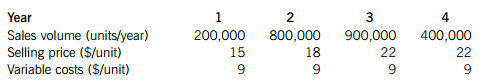

Selling price and variable cost are given here in current price terms before taking account of forecast selling price inflation of 4% per year and variable cost inflation of 5% per year.

Incremental fixed costs of $500,000 per year in current price terms would arise as a result of producing the new product. Fixed cost inflation of 8% per year is expected.

The initial investment cost of production equipment for the new product will be $2·5 million, payable at the start of the first year of operation. Production will cease at the end of four years because the new product is expected to have become obsolete due to new technology. The production equipment would have a scrap value at the end of four years of $125,000 in future value terms.

Investment in working capital of $1·5 million will be required at the start of the first year of operation. Working capital inflation of 6% per year is expected and working capital will be recovered in full at the end of four years.

Hebac Co pays corporation tax of 20% per year, with the tax liability being settled in the year in which it arises. The company can claim tax-allowable depreciation on a 25% reducing balance basis on the initial investment cost, adjusted in the final year of operation for a balancing allowance or charge. Hebac Co currently has a nominal after-tax weighted average cost of capital (WACC) of 12% and a real after-tax WACC of 8·5%. The company uses its current WACC as the discount rate for all investment projects.

Required:

(a) Calculate the net present value of the investment project in nominal terms and comment on its financial acceptability. (12 marks)

(b) Discuss how the capital asset pricing model can assist Hebac Co in making a better investment decision with respect to its new product launch. (8 marks)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Hebac Co is preparing to launc…”相关的问题

更多“Hebac Co is preparing to launc…”相关的问题