更多“54.“unit price”正确的翻译为()。 A.单价 …”相关的问题

更多“54.“unit price”正确的翻译为()。 A.单价 …”相关的问题

A、A decrease in interest rates generally leads to an increase in the value of assets.

B、Longer maturity assets have greater changes in price than shorter maturity assets for given changes in interest rates.

C、The absolute change in price per unit of maturity time for given changes in interest rates decreases over time, although the relative changes actually increase.

D、For a given percentage decrease in interest rates, assets will increase in price more than they will decrease in price for the same, but opposite increase in rates.

E、None of the above.

Heat Co is now trying to ascertain the best pricing policy that they should adopt for the Energy Buster’s launch onto the market. Demand is very responsive to price changes and research has established that, for every $15 increase in price, demand would be expected to fall by 1,000 units. If the company set the price at $735, only 1,000 units would be demanded.

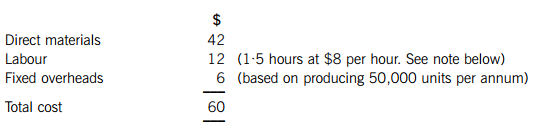

The costs of producing each air conditioning unit are as follows:

Note

The first air conditioning unit took 1·5 hours to make and labour cost $8 per hour. A 95% learning curve exists, in relation to production of the unit, although the learning curve is expected to finish after making 100 units. Heat Co’s management have said that any pricing decisions about the Energy Buster should be based on the time it takes to make the 100th unit of the product. You have been told that the learning co-efficient, b = –0·0740005.

All other costs are expected to remain the same up to the maximum demand levels.

Required:

(a) (i) Establish the demand function (equation) for air conditioning units; (3 marks)

(ii) Calculate the marginal cost for each air conditioning unit after adjusting the labour cost as required by the note above; (6 marks)

(iii) Equate marginal cost and marginal revenue in order to calculate the optimum price and quantity. (3 marks)

(b) Explain what is meant by a ‘penetration pricing’ strategy and a ‘market skimming’ strategy and discuss whether either strategy might be suitable for Heat Co when launching the Energy Buster. (8 marks)

对竞争性行业中的一个厂商的售价为5美元的产品征收销售税为1美元。

(1)税收是如何影响厂商的成本曲线的?

(2)厂商的价格、产出、利润会发生哪些变化?

(3)是否会有厂商进入或退出该行业?

A sales tax of S 1 per unit of output is placed on a particular firm whose product sells for $5 in a competitive industry with many firms.

a. How will this lax affect the cost curves for the firm?

b. What will happen to the firm' s price, output, and profit?

c. Will there be entry or exit in the industry?

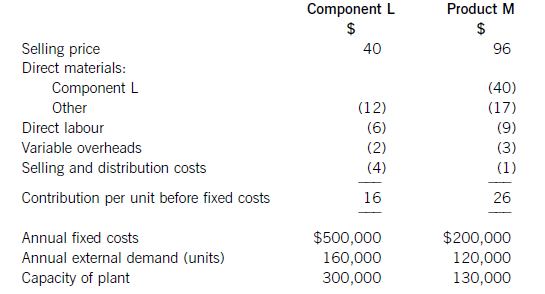

Division M makes product M using one unit of component L and other materials. It then sells the completed

product M to external customers. To date, Division M has always bought component L from Division L.

The following information is available:

Division L charges the same price for component L to both Division M and external customers. However, it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer, the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a) Calculate the incremental profit/(loss) per component for the group if Division M accepts the new supplier’s

offer and recommend how many components Division L should sell to Division M if group profits are to be

maximised. (3 marks)

(b) Using the quantities calculated in (a) and the current transfer price, calculate the total annual profits of each division and the group as a whole. (6 marks)

(c) Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L. (6 marks)

Production and sales from the new machine are expected to be 100,000 units per year. Each unit can be sold for $16 per unit and will incur variable costs of $11 per unit. Incremental fixed costs arising from the operation of the machine will be $160,000 per year.

Warden Co has an after-tax cost of capital of 11% which it uses as a discount rate in investment appraisal. The company pays profit tax one year in arrears at an annual rate of 30% per year. Capital allowances and inflation should be ignored.

Required:

(a) Calculate the net present value of investing in the new machine and advise whether the investment is financially acceptable. (7 marks)

(b) Calculate the internal rate of return of investing in the new machine and advise whether the investment is financially acceptable. (4 marks)

(c) (i) Explain briefly the meaning of the term ‘sensitivity analysis’ in the context of investment appraisal; (1 mark) (ii) Calculate the sensitivity of the investment in the new machine to a change in selling price and to a change in discount rate, and comment on your findings. (6 marks)

(d) Discuss the nature and causes of the problem of capital rationing in the context of investment appraisal, and explain how this problem can be overcome in reaching the optimal investment decision for a company. (7 marks)

从右边方格内找出与左边英语短语相匹配的翻译选项

(A) bull market ( )金融危机

(B) Certificate Public Accountant ( )价目表

(C)financiaI statement ( )财务报表

(D)futures market ( )牛市

(E)marine bills of lading ( )海运提单

(F)financiaI crisis ( )注册会计师

(G)nationaI bonds ( )贸易管制

(H)price list ( )期货市场

(I) restrai nt of trade ( )增值税

(J)value-added tax ( )国债

Complaints caused by not delivering according to the time and quantity

In the fall of 2006 ,one of our trading companies concluded a substantial rice business with an old customer in Africa. The terms of delivery are : shipment is to be made in equal monthly lots beginning from December,2006 to June,2007 and payment is to be made by irrevocable letter of credit 60 days after the date of the bill of lading. The customer established the L/C in time and all particulars of the rice, such as the name , specifications , unit price,total price and total quantity are in conformity with the contract. But the terms of shipment only stated " the latest date of shipment is June 30 ,to be shipped in several lots".

The staff in our trading company made the first shipment in December according to the quantity stated in the contract. However in order to export more and eam more foreign exchange earlier, they advanced the time of shipment regardless the shipment terms stipulated in the contract. In January 2007 , our company shipped the quantity of the first quarter once , and in February made the third shipment for the rest quantity that should be delivered in the second quarter, since our staff had not found any specifications "shipment is to be made in equal lots" in the L/C. At the same time our bank negotiated against presentation of the stipulated documents and subsequently asked the opening bank to pay for the goods. The opening bank examined the L/C and confirmed that the L/C had no error in it.

After receiving the shipping advice, the African customer found that the delivered quantity of the rice both in the second lot and third lot were not in accordance with the shipment terms stipulated in the contract, so a claim was filed by the customer against our trading company for default shipment. The amount claimed involved the added fees of chartering warehouse for the delivered goods, the interest and other charges etc. The two parties negotiated the compensation for several times, finally our company accepted the opposing party's opinion and agreed that the purchase price for the last two lots was to be paid four months later, that meant our company would receive the payment a few months later than che original stated time. According to Lhe current price in the international market at that time, our trading company suffered the loss equivalent to 10 percent of the original selling price.

Questions :

(1) What is the relationship between the letter of credit and the transaction contract?

(2) Which proof must the two parties concerned base on when they perform their obligations?

(Translate the case into Chinese and then answer the question)

Helpful hint: It is stipulated in Article 4 of the Uniform Customs and Practice for Documentary Credits that "in credit operations all parties concerned deal in documents and not in goods , service and/or other performance to which the documents may relate" .

如果结果不匹配,请

如果结果不匹配,请